Michael Saylor Bitcoin Conference Speech: Bullish Notes from Nashville

The Michael Saylor bitcoin conference speech was one filled with hope and excitement for the future of bitcoin. At the Nashville bitcoin conference, the atmosphere was electric as Michael Saylor stepped onto the stage in Nashville, a city renowned for its music and freedom. He looked out at the eager audience and expressed his delight at being in such an inspiring venue. He addressed the transformative potential of bitcoin and how it can revitalise the global economy through digital capital.

Table of Contents

Addressing the Bitcoin Revolution

As he began his presentation, Saylor utilised slides that he believed will enhance his presentation. Drawing on past experiences, he recalled how effective visual aids have impressed audiences and enhanced understanding during previous talks. He introduced the concept of the “bitcoin revolution” emphasising the urgent need for society to rebuild the global economy with digital capital. Saylor passionately argued that the current world relies heavily on outdated 20th-century ideas and technology, which are often slow and inefficient.

A Visual Comparison of Global Wealth and Bitcoin

With a powerful chart, he presented the staggering reality: while there is approximately $900 trillion in global wealth, bitcoin— a mere $1 trillion —appeared as a small orange blip on the spectrum. This visualisation highlighted the need for a paradigm shift toward digital capital. Saylor asserts that as the world inevitably evolves, bitcoin must play a pivotal role in redefining wealth and financial systems.

Michael Saylor Bitcoin Conference: Exploring the Physics of Money

Saylor transitioned into a fascinating exploration of the “physics of money”, discussing “energy, frequency, and vibration” in relation to capital. He introduced an equation that revealed the “useful life of an asset”, comparing it to the stock-to-flow ratio frequently referenced in the bitcoin community. By demonstrating the limitations of traditional financial and physical assets, he illustrated the challenges associated with capital preservation.

Challenges with Financial Assets

As he delved deeper, Saylor emphasised that the average financial asset typically lasts about 30 years, facing numerous risks that could diminish its value over time. He outlines factors that often dilute capital and draws attention to the allure of turning to physical assets for security. Citing the longest-held property, the Crown Estate in the UK, he showed how real estate has historically resisted value erosion, yet acknowledged its vulnerabilities amid economic fluctuations.

Bitcoin: An Economic Solution

Saylor presented bitcoin as the ultimate solution to the economic dilemma faced by societies today. He characterised bitcoin as immortal, immutable, and immaterial capital, capable of being retained and held over remarkably long timeframes. He excitedly shared the potential for bitcoin to have an asset life of 100,000 years when managed effectively, particularly through advancements in artificial intelligence.

Historical Context and Future Projections

Continuing his discourse, Saylor recalled significant historical transactions, such as the Dutch purchase of New Amsterdam and the Louisiana Purchase, to illustrate the potential value of digital capital. Beyond these examples, he foresees that by 2045, bitcoin could comprise 7% of the world’s assets. He emphasised that the alignment of technology and AI could revolutionise multiple sectors, resulting in the emergence of mega-corporations that could disrupt traditional asset classes.

Michael Saylor Bitcoin Conference: Strategies for Investing

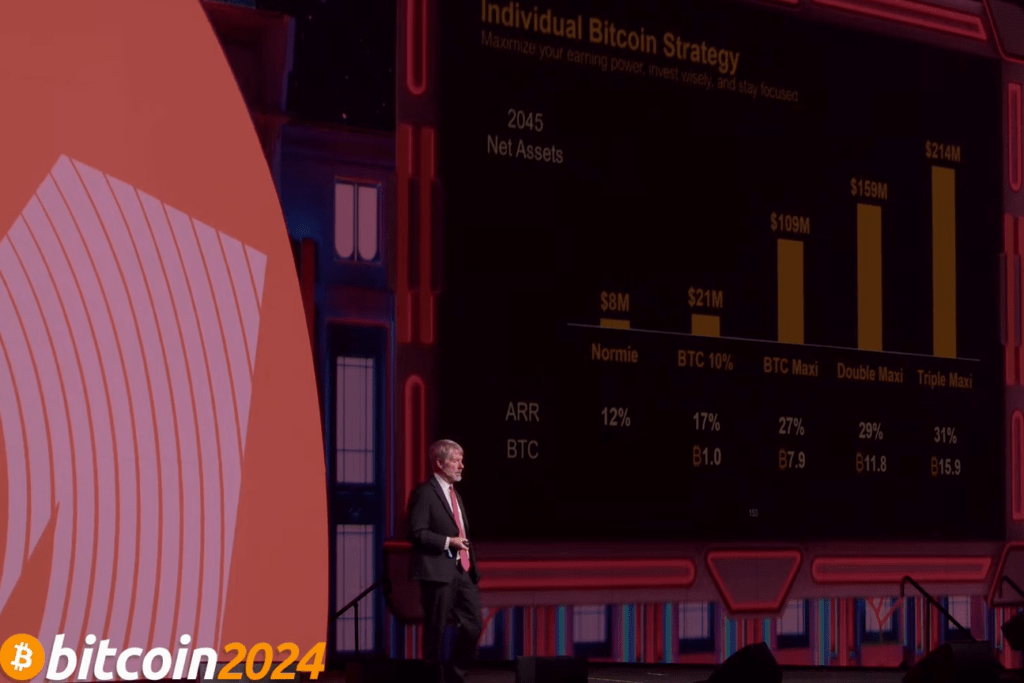

During his presentation, Saylor provided tailored strategies for individuals, corporations, and institutions to invest in bitcoin. He highlighted how leveraging concentrated bitcoin exposure offers substantial wealth creation opportunities. By using MicroStrategy as a compelling case study, he detailed the successful implementation of a corporate bitcoin strategy, inspiring attendees to consider similar avenues for their financial futures.

Michael Saylor Bitcoin Conference: The “Triple Maxi” Approach

Taking a broader perspective, Saylor discussed national strategies regarding bitcoin for both indebted and wealthier countries. He argued for the strategic reallocation of treasury assets to bitcoin, positioning it as a tool for national security and fiscal stability. However, he cautions that there may be limited opportunities for the “triple maxi” approach, given the significant amount of bitcoin required to truly make an impact.

As he wrapped up his compelling address, Saylor reiterated the profound implications of the bitcoin revolution for the United States. He emphasised an urgent need for the country to embrace this technology and avoid policies that drive industry or capital overseas. He asserts that by investing in bitcoin and other emerging technologies, the US can pave the way for unprecedented growth.

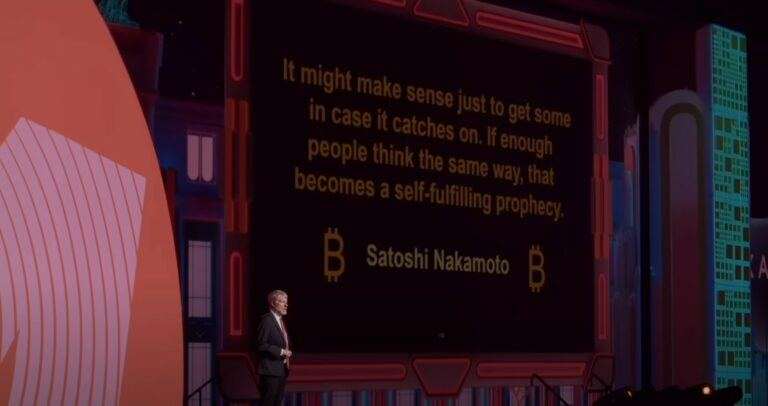

Saylor emphasised that bitcoin is more than a financial asset; it represents a vibrant vision of the future—one he describes as the “cyber Manhattan,” where capital flows freely and efficiently. He reflected on Satoshi Nakamoto’s quote from 2009, suggesting that investing in bitcoin is a wise choice as its potential continues to unfold. His passionate speech leaves the audience energised and hopeful about the possibilities that lie ahead in this new financial landscape.

3 Comments